The Philippine's stock market has withstand the global forces that dragged the stock markets around the world down.

How come our stock market is resilient?Local Economy

According to National Statistical Coordination Board, underspending by the government and the slowdown in global trade constricted the economy to a lower growth in the now 2000-based GDP of 4.9 percent in the first quarter from the election stimulated 8.4 percent last year.

According to National Statistical Coordination Board, underspending by the government and the slowdown in global trade constricted the economy to a lower growth in the now 2000-based GDP of 4.9 percent in the first quarter from the election stimulated 8.4 percent last year.On the demand side, the growth came mainly from increased investments in fixed capital formation particularly durable equipment and Household spending. Total Exports, valued at P 735.4 billion pesos fell behind Total Imports valued at P 873.1 billion pesos at current prices, resulting to a trade deficit of 137.7 billion pesos.

The above 1st quarter result of our economy is very modest. Although our government expects the GDP in Year 2011 around 7 to 8% before the Middle East tension and Japan nuclear earthquake, I think the GDP will increase in the 2nd half of the year. In fact, Standard Chartered revised it's GDP forecast in our country from 5.4 to 5.7%. World Bank also retained it's GDP forecast of 5% in our country.

The main drivers of the 2nd half GDP growth will be the government spending and the flow of investment in the country. The government will launch 10 PPP this year on infrastructure related projects. Having a portfolio in construction companies will be beneficial I think comes the 2nd half of the year because of these PPP. The costs of these PPP are big and if one company bags one of the PPP projects, it will surely hike it's stock price. An example of PPP is the C6 Expressway and Global link which is a circumferential road traversing Metro Manila to outer urban areas. It is 50 km long and 4 lane expressway worth a cool 1.2 billion dollars.

The main drivers of the 2nd half GDP growth will be the government spending and the flow of investment in the country. The government will launch 10 PPP this year on infrastructure related projects. Having a portfolio in construction companies will be beneficial I think comes the 2nd half of the year because of these PPP. The costs of these PPP are big and if one company bags one of the PPP projects, it will surely hike it's stock price. An example of PPP is the C6 Expressway and Global link which is a circumferential road traversing Metro Manila to outer urban areas. It is 50 km long and 4 lane expressway worth a cool 1.2 billion dollars.If a foreign company bags the project, that company will throw money to construct the project and the money will be classified as foreign investment. According to DPWH, it has an aggressive program under the Aquino administration that will costs 12 billion dollars. This includes toll road projects, urban mass rail transit, airport and seaport projects which will be implemented until 2016.

What are PPP's anyway? PPP according to Wikipedia, Public–private partnership (PPP) is

a venture between government and a private business which is funded and operated through a partnership of government and one or more private sector companies.

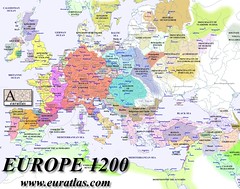

Little Exposure to Europe

Much has been said about Europe's debt crisis. Our stock market has somehow withstand these news overseas as the trading is sideways. Our banking system has a minimal exposure to Europe, thus any impending crisis in the debt of Greece and other debt ridden European countries will likely be ignored. The impact these debt crises has on Philippines is on the export sector. Imagine if Greece will default and their economy went cold, some companies may close down and if one of those companies close down and we have an export materials to that company, we will be affected.

Much has been said about Europe's debt crisis. Our stock market has somehow withstand these news overseas as the trading is sideways. Our banking system has a minimal exposure to Europe, thus any impending crisis in the debt of Greece and other debt ridden European countries will likely be ignored. The impact these debt crises has on Philippines is on the export sector. Imagine if Greece will default and their economy went cold, some companies may close down and if one of those companies close down and we have an export materials to that company, we will be affected.We now live in a global economy where one improbable event of one country could have a disastrous effect on the global economy. We are all intertwined with one another. Anyhow, we are safe here.

Rebuilding Efforts in Japan

Rebuilding Efforts in JapanJapan is our biggest trading partner right now. Since their country is recovering and needing a lot of Infrastructure and goods to stand up again, we might benefit from them immensely especially if they requires our services.

OFW Remittances

The unsung heroes of our country. According to BSP, OFW remittances for the 1st quarter totaled 4.6 billion dollars. Despite the tensions in Middle East, Japan tsunami and weak growth in US, remittances posted a 5.9% increase compared to last year. As the global economy stabilizes, more Filipinos will be deployed across the globe and remittances will increase further. These remittances helps our economy to thrive in this uncertain world.

Conclusion

Our economy is growing. While the US and western countries growth are minimal, we are experiencing a boom in our economy. In fact, we are ranked 46th in the world in the GDP nominal as of last year according to IMF. Our GDP for the 1st quarter is 4.9%, bigger than that of Thailand at 3%, Korea at 4.2% and Malaysia at 4.6%. Our GDP is still expected to top at 7 to 8% according to government officials because of the PPP that will start in 2nd half. Consumption remains buoyant also. I think 2nd half will be better than the 1st half mainly because of governments PPP. Also, consumption before Christmas drives up the GDP higher. Overall, the fundamentals of our economy remans strong and if you are investing in the stock market, it might be a good decision to buy right now to benefit in the 2nd half. Right now, the stocks are going down and are cheaper.

Our economy is growing. While the US and western countries growth are minimal, we are experiencing a boom in our economy. In fact, we are ranked 46th in the world in the GDP nominal as of last year according to IMF. Our GDP for the 1st quarter is 4.9%, bigger than that of Thailand at 3%, Korea at 4.2% and Malaysia at 4.6%. Our GDP is still expected to top at 7 to 8% according to government officials because of the PPP that will start in 2nd half. Consumption remains buoyant also. I think 2nd half will be better than the 1st half mainly because of governments PPP. Also, consumption before Christmas drives up the GDP higher. Overall, the fundamentals of our economy remans strong and if you are investing in the stock market, it might be a good decision to buy right now to benefit in the 2nd half. Right now, the stocks are going down and are cheaper.Happy investing!

Hi, what do you mean by this:

ReplyDelete"Law of Supply and Demand

Remember the Law of Supply and Demand? When the supply is limited but the buyers (demand) are plenty, the tendency of the price is to go up. On the other hand, when the buyers(demand) are plenty and the supply is limited, the tendency of the price is to go down."