Did your

credit card bill arrive already? How many bills do you have?

I have a friend

who has credit cards. Her total card balance is AED 20,000. She struggles to

pay her bills every month. The purchases of signature bags, shoes, dresses have

all accumulated into one big bill.

There is

nothing wrong in buying signature brands if you have the excesses. However, if

buying means borrowing from your credit card to pay it later, then you are simply

spending beyond your means already.

|

| http://www.flickr.com/photos/28077296@N02/5417026496 |

The cold calls

from banks collection agents are downright stressing. You cannot sleep

comfortably.

A couple of

days ago, I was reading Express, a weekly newspaper here. I flip the pages

until an article named “12 dirty tricks UAE banks play” caught my attention. Reading it made me cringe.

I don’t want

to go through the ordeal of these people.

I don’t want to feel like a criminal because of unpaid loans.

The time,

money and effort wasted on these credit cards and loans issues are just taxing.

You’ll feel tired, spent and drained.

Your daily

problems should be enough to spend your energy and yet when the collection

agent calls, you dried up.

I cannot overemphasize

the value of not incurring loans for personal consumption. It’s a trap. And

once you are in, you’ll be lucky if you’ll find a way out.

The time that

should have been spent to your family, friends, passion, hobby and moments that

will help others and humanity are taken away.

Living within

the means is the key. Coupled with financial discipline and personal development,

you’ll go far in pursuit of your dreams.

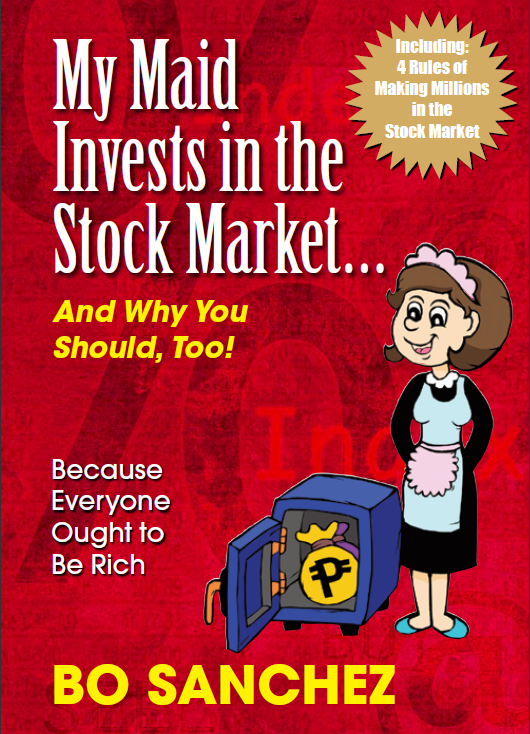

To start

arranging your finances, you can read Bo Sanchez’ My Maid Invests In the Stock Market... And Why You Should Too.

Personally, it’s a good read. Bo Sanchez explains financial

jargon in plain, simple English.